FREE tax preparation for low to moderate income taxpayers of all ages.

New location - Same amazing program!

New Ulm Community Center, Room 15

600 N German St. New Ulm, MN 56073

Call 507-276-3186 for an appointment!

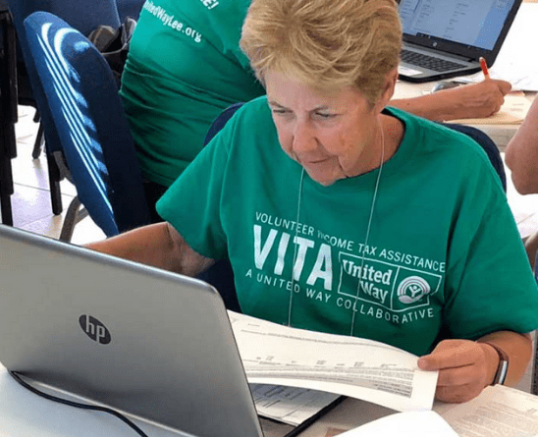

The United Way of the Brown County Area, in partnership with our Volunteer Income Tax Assistance program (VITA), will be providing a FREE tax preparation program starting Tuesday, February 10th, through April 15th in the lower level of the New Ulm Community Center located at 600 North German St. This program is run by local IRS certified volunteers that work with the United Way and VITA to provide this much-needed service in our community. The tax preparation program is specifically for those who cannot afford to have their taxes done or who cannot complete them through a free online site. The tax team cannot do all taxes, but can help those with Federal and Minnesota income taxes and some property taxes. To have your taxes done, you must have a scheduled appointment, be prepared with all your tax documents on the day and time of your appointment, and be willing to reschedule if you are feeling sick or experiencing any COVID symptoms on the day of your appointment. To schedule an appointment, please call 507-276-3186.

This service is made possible by a grant provided by the State of Minnesota and a partnership with Community and Seniors Together (CAST).

For those with access to and experience filing their taxes online, please go to MyFreeTaxes.com to file for FREE!

If you would like to volunteer or learn more about becoming a tax preparer, please call our designated Tax Program line at 507-276-3186.

MyFreeTaxes.com

MyFreeTaxes is an online tax filing program that helps users file their taxes for free while getting the assistance they need. United Way provides MyFreeTaxes in partnership with the IRS’s Volunteer Income Tax Assistance (VITA) program.

The MyFreeTaxes self-preparation option has no age restrictions, and no geographic limitations, and includes federal and unlimited state returns for free. This program is free for those who make $89,000 or less, but filers with incomes over this threshold will not be blocked from using the software.

This service made possible through a grant provided by the State of Minnesota.